Performance compensation (bonus, LTI)

Analysing the existing situation

- Business model of the company : value proposition, translation into value creation (value drivers, buy versus make, organic versus external growth…) ;

- Culture & values of the company : autonomy, creativity, promotion, team spirit, employee proposition…;

- Management processes : value creation measurement and goals, strategic planning and budgeting, value drivers identification, information systems, performance assessment, determination of remuneration ;

- Strengths and weaknesses of existing compensation practices.

Defining the goals of remuneration incentives

- Specific role of short-term incentives within the global compensation package ;

- Specific role of long-term incentives within the global compensation package.

Designing the short-term incentive

- Choice of performance metrics (financial, strategic, operating, leadership…), organisational level (group, BU…) and combination of metrics (additive, multiplicative) ;

- Target setting and payout curve ;

- Possible performance comparator group ;

- Possible deferral ;

- Compliance check ;

- Possible adjustments of managerial processes ;

- Implementation.

Designing the long-term incentive

- Choice of vehicle: full-value shares, stock options, indexed instruments settled in cash, long-term bonus…;

- Choice of performance metrics (financial, strategic…), organisational level (group, BU…) and combination of metrics (additive, multiplicative) ;

- Possible performance comparator group with optimisation in case of relative TSR metric ;

- Length of vesting period and holding period ;

- Target setting and payout curve ;

- Optimisation of IFRS 2 fair value ;

- Compliance check ;

- Possible adjustments of managerial processes ;

- Implementation (legal documents, internal and external communication…).

Award setting

- Benchmarks of executive compensation packages (by band, through job matching) and market positioning ;

- Benchmarks of dilution rate and IFRS 2 expensing ;

- Translation of benchmarks into a number of equity vehicles to grant.

Communication

- Internal ;

- External : investors, AGM proposals…

CO-INVESTMENT : A LEVER TO OPTIMIZE THE EXECUTIVE COMPENSATION PACKAGE !

THE LEVERAGE MANAGEMENT PACKAGE (LCP)

Some listed companies encourage executives to co-invest in the firm’s equity ; some even consider it to be part of their DNA. But this is not (yet) a widespread practice in France for listed companies, whereas many private ones use it.

1. Why deprive yourself of this lever ?

Investing in the firm’s equity may seem to be a constraint for executives, while this can be a tremendous opportunity to both increase the attractiveness of the Long Term Incentive plan (LTI) for beneficiaries and its effectiveness for the company ...

Co-investment is virtuous because :

- It strongly aligns management with the interests of its shareholders, by taking a financial risk by acquiring shares ;

- Executives clearly show to shareholders and employees their commitment in the long term success of the company.

2. Conditions of success

The objective of co-investment is to support an entrepreneurial culture, with executives being incentivated to achieve higher levels of performance. It ensures major commitment from executives when in charge of driving major changes for the company : adaptation to an economic crisis context, new strategy, search for significantly higher levels of results, merger, acquisition ...

To succeed, and get the adhesion of executives, co-investment requires :

- The strong involvement of the CEO and the Compensation Committee, thus gathering the executive team around a project ;

- Attractive investment modalities for beneficiaries ;

- The perspective of a financial turnaround when the business plan is reached.

As a result of the executives’ commitment to the company’s success (via that investment into the shares of the company), the shareholders are ready to significantly reward the executives with additional share allocation.

3. Leverage Compensation Package (LCP)

The co-investment terms are diverse : ad hoc structure, warrants and preference shares (which have lost their appeal in France for tax and social reasons), Share Matching (in the UK sense) ...

The LCP is the system which offers the best optimization plan : it consists of individual financing via a freeze and / or a waiver of salary, with the possibility of a complementary share contribution by the company.

The participants

It is important to determine the number and selection of executives (and other key people) who must be part of the LCP plan.

The involvement of the executives of the first circle is natural ; it is possible to extend it to other circles, offering them voluntary participation.

A reserve of sweet equity may be put in place in order to allow for new entrants, either through internal promotion or external recruitment.

The management package

The terms of the management package can be extremely diverse, whether they are :

- The duration of the plan ;

- The amount of the individual investment ;

- The amount of the company contribution ;

- The possibility of an additional company contribution at mid-term, in relation to the achievement of a mid-term objective, to further enhance the implication of the beneficiaries during the period of the plan ;

- The acceleration of the plan if the business plan is completed prior the maturity ;

- The application of an amplifier system, making it possible to increase very significantly the package shares allocated by the company in the event of outperformance ;

- The application of a clawback clause concerning the company contribution, in case of underperformance ...

Instruments

The choice of instruments is very open ; the following ones are currently favored :

- Performance share grants ;

- Phantom Stocks, which are in some cases more favorable than shares from a fiscal and social point of view, and less dilutive ...

Optimization levers

The LCP allows executives to leverage their optimization plan :

- Tax arbitration between capital settlement and cash settlement, depending on the applicable tax and social regime to share and stock-option grants.

- Investment through a waiver of salary : this is neutral for the company, but much more favorable to the beneficiaries :

- For cash reasons : the financing being spread over the duration of the plan (generally 3 to 5 years), instead of being financed upfront in full ;

- The calculation of the waiver takes into account the company contributions.

Example : assuming 38.50% of employee contribution rate, 17.20% of salary cost and 48% of marginal income tax rate, the net-net investment (after tax) of the executive represents 31% of the equivalent investment on the stock market.

- The company contribution, which generally represents 1 to 4 times the amount of the individual investment, depending on the performance of the company ;

- Economic optimization, i.e. the reduction of the fair value of the share, allowing for a given IFRS 2 value to increase the number of allocated shares and thus the potential gain of the plan.

We would be pleased to discuss with you the opportunity to optimize the LTI plan of your company.

ALVA : THE NEW GENERATION OF LONG-TERM INCENTIVES (Asset with Leverage Vectoring Aptitude)

The payout potential of traditional full-value share and stock option grants relative to grant size is unfortunately low under share price scenarios consistent with ambitious but achievable business plan targets.

To optimise the leverage of equity-based incentives, we suggest the grant of ALVAs, a structured equity vehicle combining systematically the grant of full-value shares with an appropriate set of market conditions. This combination lowers significantly the fair value of the shares which in turn allows the increase of the number of shares vesting under share price scenarios identified as consistent with the business plan targets.

The payout of the ALVAs can jump by more than 50% compared with traditional equity grants.

Introduction

Equity-linked long-term incentives (LTI) usually involve the grant of two types of equity instruments : full-value stocks and stock-options.

Vesting conditions of equity-linked LTI awards often solely include service and non-market performance conditions, i.e. primarily financial metrics.

The absence of market conditions (and other optimising design features) unfortunately reduces the ability of full-value shares to compensate effectively the attainment of ambitious but achievable business plan targets. The same holds for fair value stock-options, i.e., options where the exercise price equals the share price on grant date. Indeed, the leverage or effectiveness ratio of these instruments is weak, around 1.3: for 100 € of fair value granted, the expected payout on vesting under share price scenarios consistent with an ambitious but achievable business plan is a mere 130€!

An ALVA (Asset with Leverage Vectoring Aptitude) is a structured equity instrument that can increase by more than 50% the expected payout of LTI plans.

1. Why traditional full-value shares and stock-option awards are ineffective

The payout of an equity-based LTI is a function of the evolution of the value of the share price. For the sake of simplicity, we will focus the discussion on public companies but the concepts illustrated hereafter can be extrapolated to private companies.

The share price performance of a company can be estimated both in absolute and relative terms :

- The Total Shareholder Return (TSR) including capital gain and re-investment of dividends, measures the absolute return that benefits the shareholder over a given period ;

- Relative TSR compares the absolute TSR of the company against a comparator group; it is also an assessment of the performance of the company’s management by reducing the impact of exogenous factors on the share price performance.

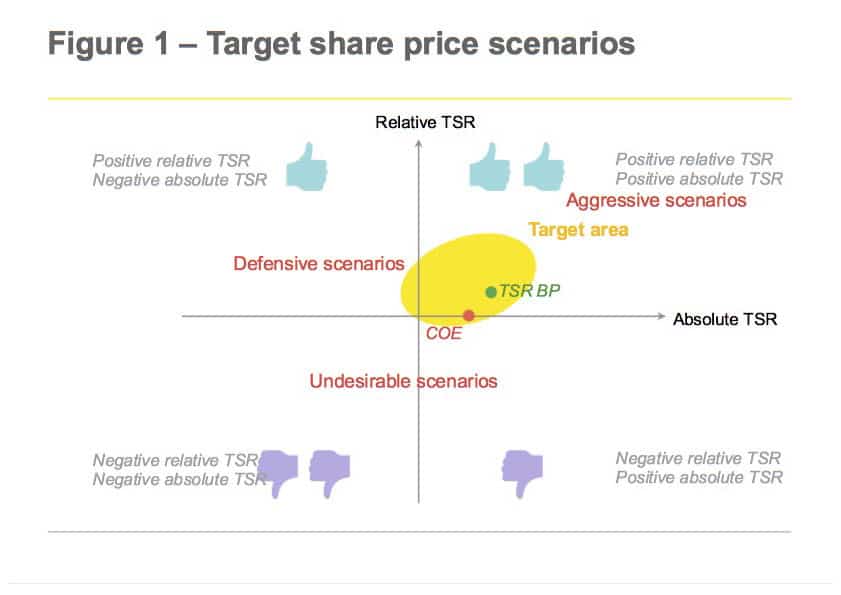

Figure 1 illustrates how in this two-dimensional space describing share price performance, it is possible to identify a target area of share price scenarios (ellipse) where we would like the granted equity instrument to provide the highest possible payout.

The target area includes scenarios :

- Where absolute and relative TSR are attractive to shareholders ;

- Likely to occur given the stochastic features of the share price (risk premium expected by investors, volatility, correlation with the comparator group…) ;

- Consistent with the business plan targets.

The first criteria implies that the target area should be located in the north-east quadrant of the two-dimensional space.

The second criteria involves that the target area includes the Cost Of Equity (COE) of the firm as the market sets the share price discounting at this rate the expected future profits.

To ensure consistency with the business plan (third criteria), the target area also needs to include the TSR anticipated by insiders as resulting from the business plan targets (TSR BP). An ambitious business plan should imply a TSR that exceeds the COE of the firm . TSR BP is therefore in principle located to the right of and above the COE.

Outside of the target area, three other types of share price scenarios can be identified :

- « Undesirable » scenarios characterised by the underperformance of the company against the comparator group (negative relative TSR), usually also involving a drop in the share price ;

- « Aggressive » scenarios with a spectacular share price performance both in absolute and relative terms but that are ex ante statistically unlikely and that might occur as the result of a windfall (bull market…) or excessive risk taking ;

- « Defensive » scenarios that to some extent protect investors from a declining share price (possibly significant) thanks to superior management performance (positive relative TSR).

The fair value of an equity instrument (e.g., as estimated under IFRS) estimates its reward potential as it equals, by definition, the discounted value of the expected payout of the instrument. However, this estimate of the reward potential is just an average assessed across all share price scenarios. It is more insightful to understand how the fair value is allocated over the target area and other types of share price scenarios. The more the fair value of an equity instrument is allocated to the target area, the higher its reward potential over share price scenarios consistent with business plan targets.

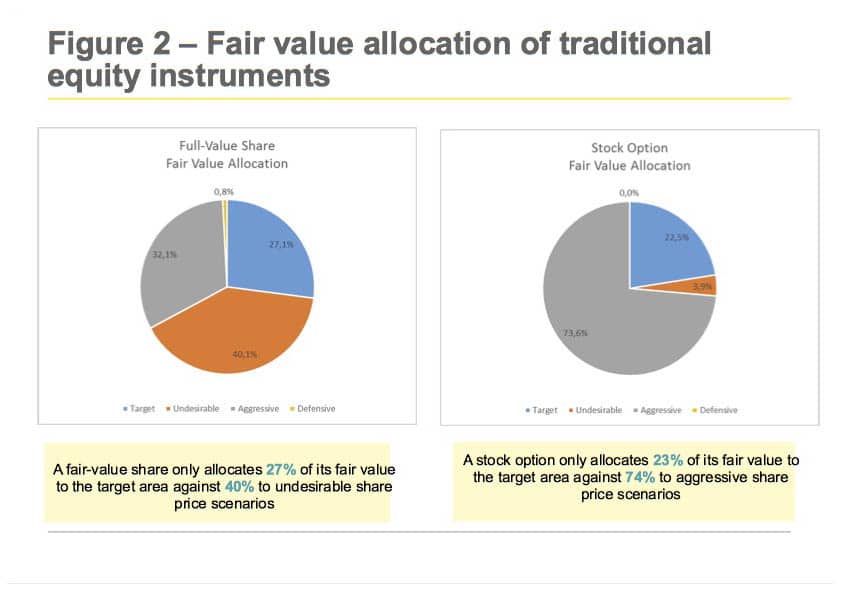

Figure 2 analyses the distribution of the reward potential of traditional equity instruments over the target area and other share price scenarios as described before :

A traditional full-value share (i.e., not subjet to market conditions) only allocates 27% of its fair value to the target area while 40% of its fair value compensates undesirable scenarios where the share price not only underperforms the comparator group but most of the time drops, sometimes even severely.

A fair-value stock-option (exercise price = share price on grant) performs even worth than a full-value share as a mere 23% of the fair value is allocated to the target area. Almost 75% is dedicated to aggressive share price scenarios that are unlikely with regard to an ambitious but achievable business plan, unless the share price benefits from a windfall such as a bull market or management deliberately increases risk.

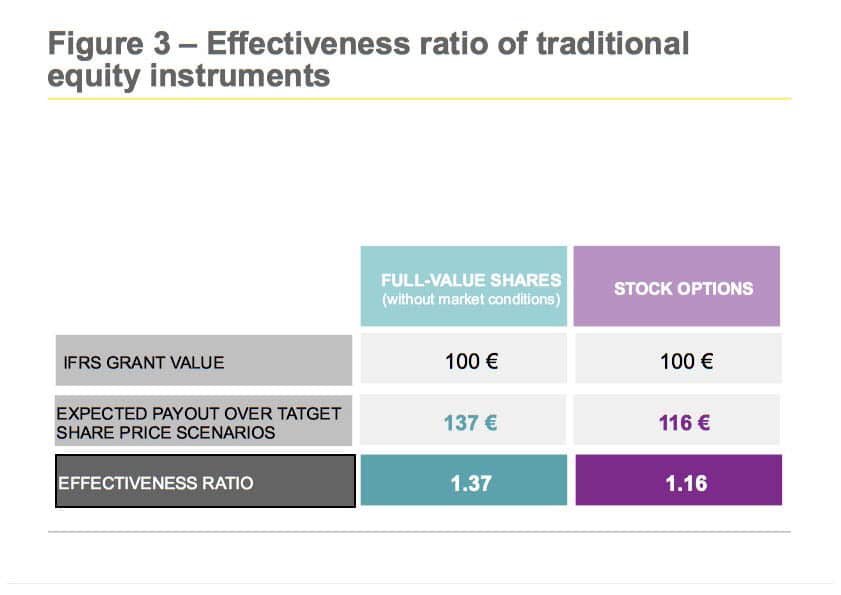

Given the inherent weaknesses of full-value shares and stock-options, what is the reward potential of these two equity instruments over the target area of share price scenarios consistent with the business plan? To find out we estimate the effectiveness ratio, i.e., the ratio between the average payout over the target area and the initial amount of fair value granted (100 € by assumption). Figure 3 summarises the effectiveness of traditional equity instruments :

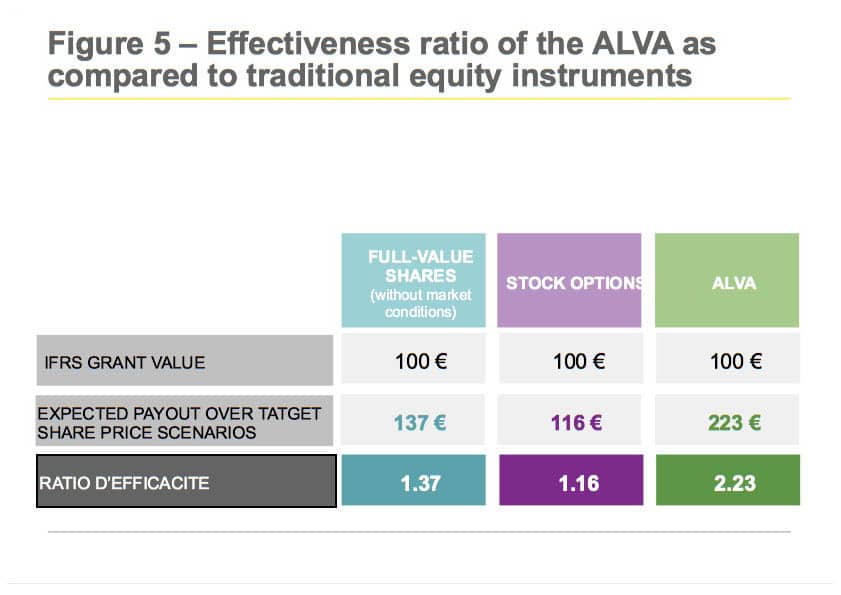

For 100 € of fair value granted, a full-value share yields on average an estimated payout of 137 € over the target area, i.e., an effectiveness ratio of 1.37. This means that if full-value shares are granted, performing executives that deliver a business plan beyond market expectations can only hope adding 37% to the initial value that was granted.

The estimated effectiveness ratio of fair-value stock-options is 1.16, even less than that of full-value shares. This may seem surprising given the inherent leverage of stock-options. The distribution analyses of fair value explains this poor leverage: the contribution of the target area to fair value is lower in the case of the stock option than in the case of the share. In summary, the option lever intervenes too late as it is triggered by share price performance scenarios that are excessively aggressive considering ambitious but achievable business plan targets.

2. The effectiveness of an ALVA

An Asset with Leverage Vectoring Aptitude (ALVA) is purposely designed to raise the potential payout on a defined target area of share price scenarios, i.e., scenarios consistent with an ambitious but achievable business plan, that demonstrate superior management performance and that increase shareholder wealth, both in relative and absolute terms.

The ALVA is structured by combining systematically the grant of full-value shares with market conditions and other fair value « vectoring » features that transfer fair value allocation towards the target area. The ALVA, like a traditional full-value share or a stock-option, can moreover be combined with non-market conditions.

Fair value saved on share price scenarios outside the target area lower the fair value of the ALVA. This reduction allows for a given IFRS grant size, to increase significantly the number of shares granted compared to traditional full-value share grants. The vesting of the additional shares granted is concentrated on the target area to raise its reward potential.

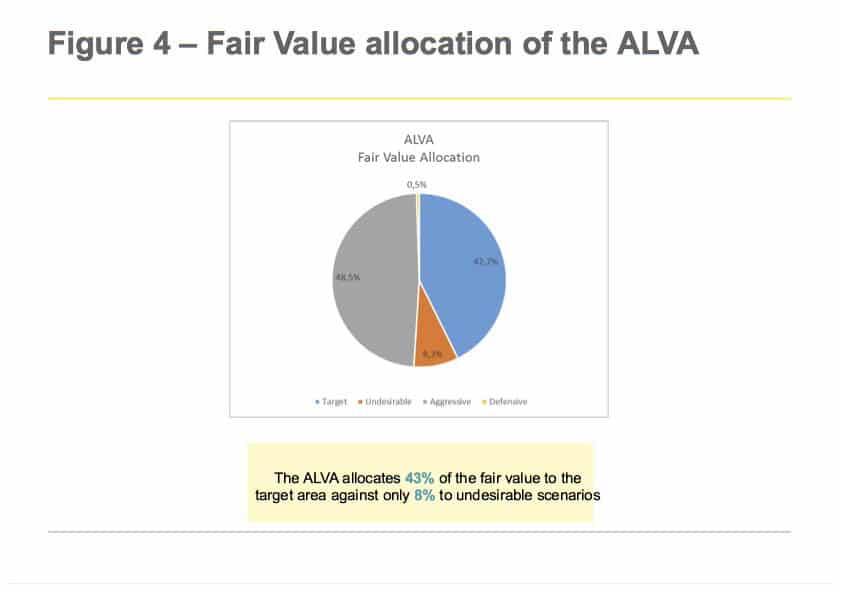

To illustrate the potency of the deliberate concentration of the payout potential of an ALVA on the target zone, we designed an ALVA whose fair value allocation is described in figure 4 :

The chosen ALVA « vectorises » 43% of fair value into the target area, i.e., an increase of 58% compared to a traditional full-value share without market conditions. The contribution of undesirable scenarios drops to 8% as compared to 40% for the fair-value share.

Figure 5 compares the effectiveness ratio of the ALVA with that of the traditional equity instruments :

The effectiveness ratio increases from 1.37 for the traditional full-value share without market conditions to 2.23 for the ALVA, i.e., a rise of 63% of the average payout over the target area!

The increase of the reward potential provided by an ALVA can possibly be shared between the LTI beneficiaries and the company if the latter choses to reduce the IFRS cost of the plan. The ALVA that we illustrated includes absolute and relative share price performance conditions. The absolute condition was parameterised in such a way that the ALVA would be sufficiently resilient in bear markets provided that the relative performance is satisfactory.

Besides a superior effectiveness ratio, this is another major advantage of the ALVA over the stock-option that tends to vest under water in bear markets, whatever the relative performance.

3. Conclusions

The ALVA brings a major breakthrough in the design of equity-based long-term incentives :

- The ALVA permits to include in the communication towards beneficiaries and investors a strong link between value creation and remuneration ;

- The ALVA increases significantly the reward potential as compared with traditional full-value shares and stock-options ;

- If the company wishes so, the ALVA allows cost savings.

Another advantage of the ALVA is that it rests on the familiar legal framework applicable to the grant of full-value shares.

The ALVA offers an improved leverage compared to full-value shares without the excess possibly characterising stock-options. Moreover, contrary to stock-options, the ALVA can be tuned to be resilient in bear markets.

We will be happy to discuss in more details the potential benefits of ALVAs during a meeting.

1. The market sets the share price in such a way that the TSR expected by the market equals the COE. If the ambition of the business plan target was implying a TSR below the COE, once the market would become aware it would lower the share price.