Governance

The Board of directors outlines the strategy of the company, appoints the executive directors, determines their remuneration, and looks after the communication towards shareholders and the market.

It is the Board’s responsibility to specify how it is organised and how it operates depending on the business and culture of the company, and to reflect on its role, responsibility and effectiveness.

The Board checks the compliance of the company with the governance code it refers to (in France AFEP-MEDEF Code for large caps, MiddleNext Code for mid-sized public companies…) and, moreover, identifies possible red flags :

- Reputational risk among investors: compliance is no guarantee; red flags allow the identification of risks linked to voting guidelines of investors and proxies, or even that stem from media and public opinion ;

- Governance improvement opportunities ;

- Opportunities to highlight best practices through communication.

Board and committees evaluation

Following the Bouton report, recommendations of the European Union, and in line with international best practices, a public company has the obligation to assess how the Board and its committees are organised and operate.

To ensure objectivity and confidentiality, an increasing number of corporations rely on external consultants to organise and conduct such an evaluation.

This assessment typically includes :

- The evaluation of the compliance against the governance code the company refers to (AFEP-MEDEF code, MiddleNext code…) ;

- The evaluation of the effectiveness of the Board and its committees.

Compliance assesment with governance code

Compliance evaluation includes :

- Comparing the company’s practices with guidelines of the corporate governance code it refers to, red flagging departures from the code and assessing the explanations provided ;

- Comparing the company’s practices with sources of best practices or trends worth to consider such as recommendations/expectations from AMF (French financial markets regulator), IFA (French institute of directors), voting guidelines of proxies and leading institutional investors, major foreign governance codes (e.g., UK Corporate Governance Code aka Combined Code) ;

- Reviewing the “Say on Pay” practices (when applicable).

Effectiveness evaluation of the Board and committees

The purpose is to gage the effectiveness of the Board and its committees and in this way help identifying areas of improvement.

Following aspects are reviewed :

- Composition of the Board, degree of independence, diversity, complementarity of expertise ;

- Composition of the committees, independence, complementarity of expertise ;

- Organisation of the committees ;

- Operation of the committees ;

- Contribution of the committees against expectations ;

- Methodologies implemented by committees ;

- Internal and external resources made available to the committees ;

- Induction / training of Board members ;

- Board compensation.

Methodology

The evaluation process rests on the conduct of individual interviews with the Board members, complemented with the consultation of corporate documents related to the work performed by the Board and its committees. An interview guide is sent in advance of the meetings to all the Board members. It covers all the aspects mentioned above and allows the understanding of how these elements relate to each other.

Our approach includes five steps :

- Conduct one or two meetings with the Board secretary, and possibly with the chair of the remuneration committee , to review the evaluation process and methodology, and agree on potential adjustments ;

- Review any relevant documentation provided by the company ;

- Conduct the individual interviews with Board members, which can be held at the company’s headquarters or any other convenient locations for the interviewees ;

- Prepare a summary report of the interviews including a description of widely supported practices, but also concerns and suggestions of improvement. We comment the various themes evoked and put them in the context of Corporate Governance ;

- Present the summary report during a meeting with the full Board and possibly with the remuneration committee.

Remuneration Committee

To legitimise the compensation packages of executives (executive directors, other Executive Committee members), the Board and the remuneration committee need to define the guiding principles and remuneration practices in light of the company’s strategy and values, and monitor the implementation of these compensation principles and practices.

The hiring process of external consultants should also be specified to ensure their independence.

Since executive compensation matters have become so complex, and considering how sensitive they are with multiple ramifications, they require a high level of expertise in different fields.

Our involvement includes governance and executive compensation-related matters.

For illustrative purposes we provide a brief description of client assignments :

- Benchmark of the composition, operation and role of the remuneration committee against a relevant comparator group ;

- Draft of a revised charter of a remuneration committee considering both the evolution of governance principles and practices and the company’s specificity ;

- Implementation of the AFEP-MEDEF code regarding terms and conditions applicable to executive directors while taking into account the company’s and the executives’ interests ;

- Benchmarking of executive compensation packages against French and international practices ;

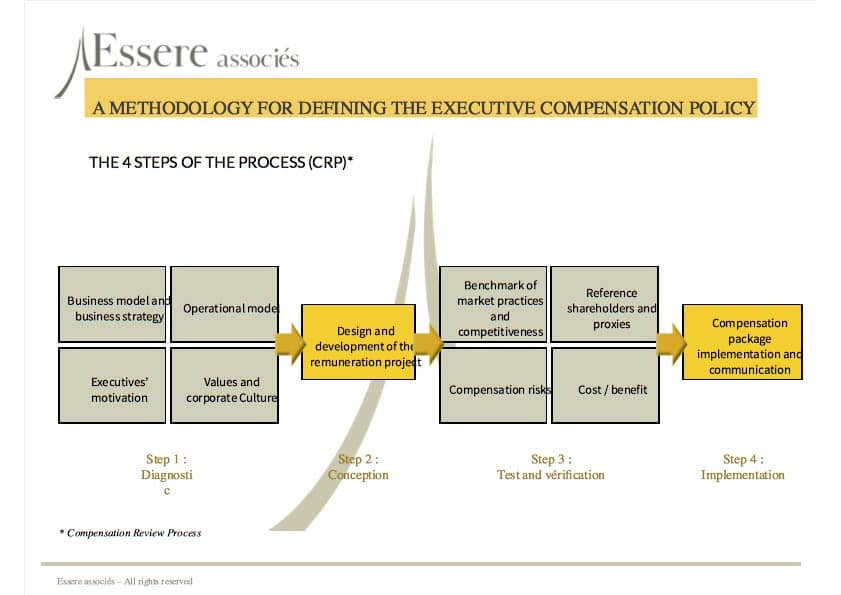

- Definition and implementation of the executive compensation policy covering the entire package : base, bonus, LTI, retirement, severance…;

- Draft of communication considering the governance code requirements, recommendations of the financial markets regulator AMF, and expectations of investors and proxies.